Are you looking for long term vs short term investment for better Results In the Stock Market, novices or experienced in the field of investments are always looking for ways to get the best return on your money. This holds true when it comes to stock market investing.

Depending on an investor’s goals and timeline, there may be a better option than others when it comes to investing in stocks. In this blog post, we will explore the benefits of long-term and short-term investment strategies and what type of investor each is most suited for.

Long-term and short-term investing are the two most popular investment methods in the stock market. Before investing your money, it’s critical to know which of these tactics would be most effective for you because each of them has unique benefits and drawbacks.

Know the difference between Long Term Vs Short Term Investment. Let us take a closer look at both investments, and see which one is more likely to result in a successful return on your investment. Read on to find out more.

Contents

What Is A Short-Term Investment?

A short-term investment is any type of investment that provides a relatively quick return on capital. This can include things like stocks, bonds, or real estate, as well as more unconventional investments like peer-to-peer lending.

Which is better Long Term Vs Short Term Investment? The purpose of a short-term investment is typically to generate quick returns that can be used for a specific purpose, such as paying for an upcoming expense or funding an important project.

However, it’s important to remember that though these types of investments offer the prospect of higher returns in the short term, they also come with increased risk. As such, it’s important to carefully consider your risks and financial goals before making any sort of short-term investment.

Examples Of Short-term Investments:

Treasury Bills

Treasury bills, or T-bills for short, are short-term investments that can be redeemed after a period of 91 days. Unlike other types of securities, such as bonds or mutual funds, T-bills are purchased at a discount to their face value and can offer relatively high returns compared to their short maturity periods.

Gilt Funds

Gilt funds are a type of short-term investment vehicle that offers zero credit risk while enabling investors to benefit from the relatively high yields associated with government securities.

These funds invest primarily in government bonds, typically at the shortest end of the yield curve. By investing in securities with zero credit risk and minimal duration risk, gilt funds are able to offer higher returns than many other types of fixed-income investments.

Bank Fixed Deposits

Bank fixed deposits, or FDs, are a popular investment option for those looking to earn steady returns on their money. A savings account known as an FD is one in which the money is kept for a set amount of time and earns interest at a set rate.

This interest rate can vary depending on several factors, such as the length of the deposit period and the current state of the economy.

Money Market Instruments

Money market instruments are financial products that are designed to help investors generate income through low-risk investments. These instruments typically include things like commercial papers and certificates of deposit, which all involve purchasing short-term debt from the government or a private company.

Money market instruments can also include other securities, such as asset-backed bonds and repurchase agreements.

Recurring Deposits

Recurring deposits, or RD accounts, are a type of investment product offered by banks and other financial institutions. With recurring deposits, you make consistent payments over time, such as every month or every three months.

These contributions can be made in fixed amounts or can vary depending on your income and net worth. In return for your contributions, you earn interest on your deposit at a set rate that is typically higher than the rate you would receive on a savings account.

Post Office Time Deposits

Post office time deposits are special accounts that individuals can open up at their local post offices. These accounts offer a number of unique benefits, including higher interest rates than typical savings or checking accounts and the ability to withdraw funds on a daily basis without incurring any penalties.

Post office time deposits are safe and secure and are backed by the full faith and credit of the government, unlike many other investment options.

Other Short-term Instruments Include:

- Low-duration debt funds

- Money market funds

- Company fixed deposits

- Post office time deposits

- Sweep-in-Fixed Deposits

- Large-cap mutual funds

What Is A Long-Term Investment?

A long-term investment is one that typically involves more market risks and higher returns than more conventional investments. Typically, these kinds of investments involve assets such as stocks, bonds, or real estate, which tend to fluctuate more dramatically in value than more stable assets like cash equivalents.

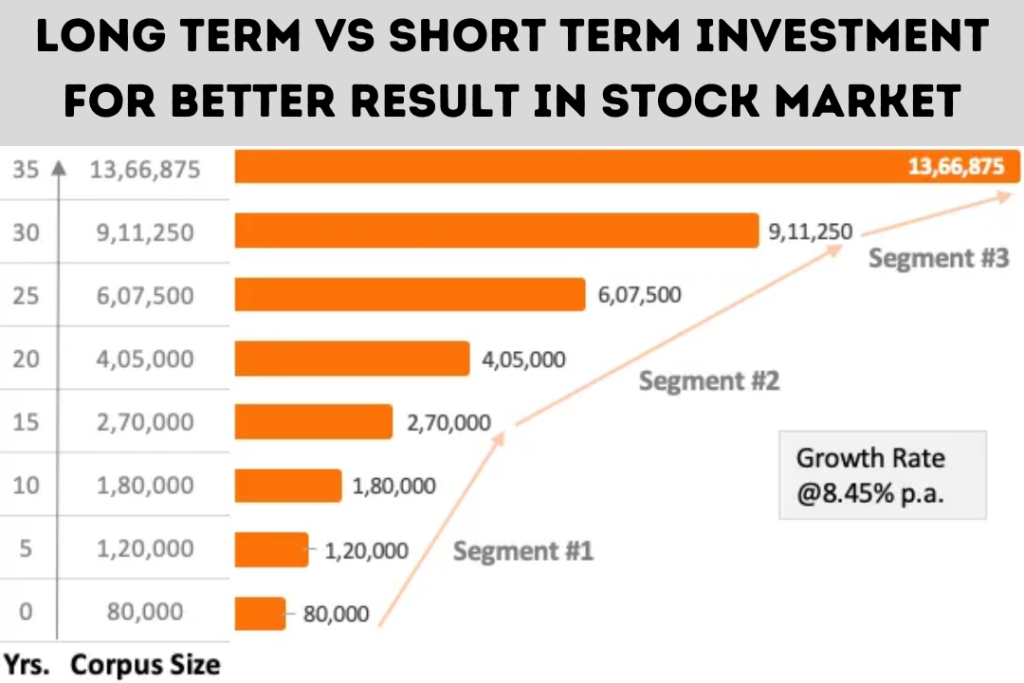

Which is better Long Term Vs Short Term Investment? Because these kinds of investments involve more risk, they are often considered more suitable for longer timeframes, such as more than 5 years. While there is no guarantee that such investments will pay off over the long term, they have historically shown higher rates of return than more conservative options.

Examples Of Long-term Investments:

Stocks

Stocks are an investment instrument that allows people to purchase shares in a company. These shares represent a small ownership stake in the company, giving investors a proportional claim on its profits and assets. To some extent, stocks function like bonds, since they provide a way for companies to raise money from individual investors.

However, unlike bonds, which are typically issued for a set period of time, stocks can be traded at any time by their holders. The value of individual stocks fluctuates based on many factors, including the overall performance of the stock market as well as specific economic conditions and company-specific news.

Despite their inherent riskiness, stocks continue to be one of the most popular investment vehicles among both individual and institutional investors. Anyone hoping to accumulate wealth over the long run has to have a solid understanding of how stocks operate.

Equity Mutual Funds

Equity mutual funds are financial instruments that offer investors an opportunity to access the stock market in a diversified and relatively low-risk way. Unlike individual stocks, which can be highly volatile, equity mutual funds are composed of many different equities, making them more stable overall.

Long Term Vs Short Term Investment – Which One Is Better?

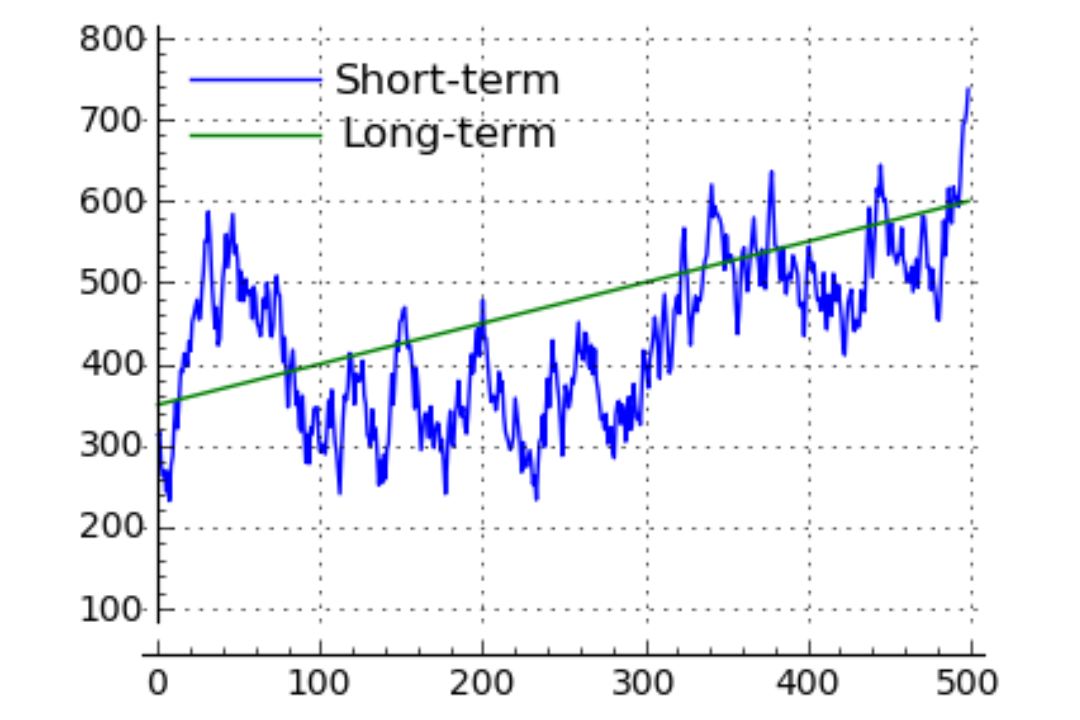

When it comes to investing, there is often a tradeoff between short-term and long-term gains. On the one hand, short-term investments offer the potential for significant returns right away, but they can also entail greater risk.

Conversely, long-term investments typically involve less risk but may not provide as high returns in the short term. Which investment is therefore better? Your objectives and risk tolerance will determine this.

On one hand, short-term investments can be quite lucrative, as they allow you to quickly take advantage of market trends and fluctuations. For example, if you spot a sudden spike in fuel prices, you can buy shares in oil companies and then sell them again when the prices drop.

“Long Term Vs Short Term Investment” However, this type of trading requires a certain level of risk tolerance, as small changes in the market can mean significant losses or gains.

On the other hand, long-term investments provide more stability and security. For example, investing in stocks that have a proven track record of growth may provide returns over time but with less risk than actively trading stocks.

Furthermore, holding on to long-term investments means that you can take advantage of compound interest and ride out any short-term market volatility.

However, while each approach has its own pros and cons, ultimately both strategies are designed to help grow your wealth over time by helping you make smart financial decisions every step of the way.

So if you are looking for fast money and don’t mind taking some risks along the way, then a short-term investment may be the best option for you. But if you are seeking stability and reliability over the long term, then a long-term investment may be more suitable.

In the end, your own demands and circumstances will determine which strategy you employ. However, with proper planning and research, either approach is likely to be successful in helping you meet your financial goals.

Conclusion

So, is it better to invest in the long term or the short term in the stock market? “Long Term Vs Short Term Investment?” The answer is that it depends on your goals and what you hope to achieve. Generally speaking, if you are looking for stability and modest growth, investing for the long term may be a better option.

Looking for a Long Term Vs Short Term Investment? However, if you are looking for higher returns with more risk, then investing in shorter time frames may be a better choice. Ultimately, it is important to remember that there is no one right answer – only what works best for each individual investor’s unique situation.

What to choose Long Term Vs Short Term Investment? Have you made up your mind if you’ll make long-term or short-term investments? What factors led you to your decision? Do tell us in the comments.