How do most states finance their capital budget? Read till the end to understand in depth.

Capital budgets are a key part of any state’s overall financial operations. These budgets concern the large investments and major projects that positively impact a state’s economy, such as transportation and utility infrastructure, public institutions like schools and universities, and development projects intended to spur economic growth.

In general, capital budgets are financed via a combination of taxes, fees, grants, bonds, and loans from other governmental entities or private lenders. Each state has its own system for funding capital expenditures, but there are some commonalities across states.

While some states rely primarily on taxes to finance their capital budgets, others depend largely on bond sales or other loans. Some states use a mix of these strategies to ensure that they have adequate funding for the investments that they need.

How Do Most States Finance Their Capital Budget? Additionally, all states rely on fee-for-service structures to generate revenues for capital budget items such as new buildings or public works projects. A strong capital budget is crucial for supporting sustainable economic growth over the long term.

Contents

What Is Capital Budget For The State?

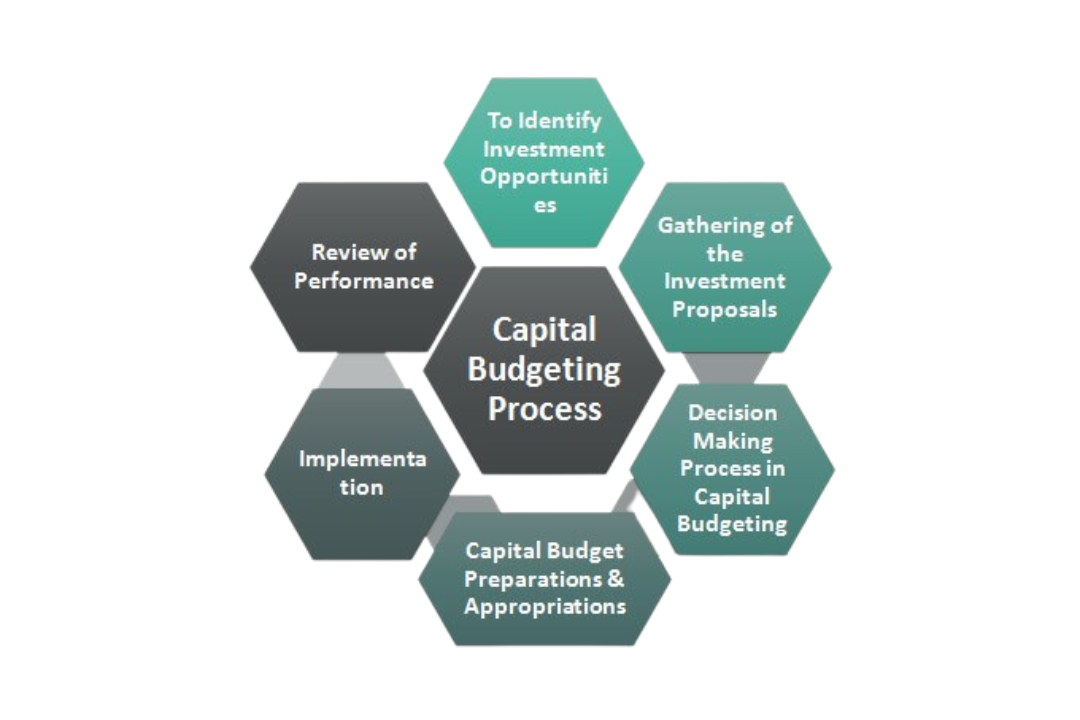

Capital budgeting is a key component of fiscal policy in any state or country. This is the process by which governments allocate scarce financial resources to different areas, including infrastructure, education, healthcare, and public safety.

At the heart of capital, budgeting is the allocation of funds to various projects that aim to improve the overall welfare of citizens. These may include investments in roads and highways, new schools and hospitals, or utilities such as water and electricity systems.

The ultimate goal of capital budgeting is to ensure that all areas of society have access to the goods and services necessary for their long-term well-being. Therefore, it is an incredibly important tool for governments as they work to foster economic growth and development in their communities.

Major Sources Of Capital Funds For States

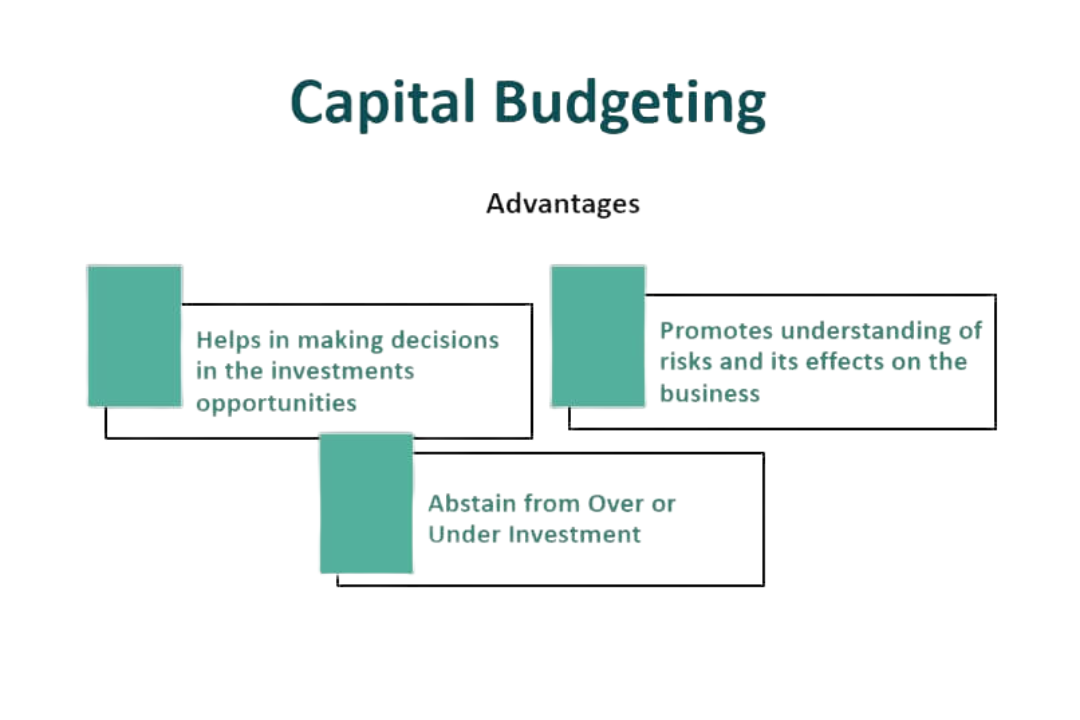

There are a variety of different approaches that states can take to finance their capital budget in order to meet their various needs and priorities.

General Funds💸💸💸

There are a variety of different methods that states use to finance their capital budgets. The most common approaches include general obligation bonds, general funds, and transportation revenue bonds.

One type of general obligation bond is the popularly known “GO Bond“, which is generally used by states to fund large projects such as infrastructure upgrades or public buildings. These bonds are typically backed by a pledge of state tax revenues, giving investors confidence that the funds will be repaid.

Another common method for financing capital projects is through general funds. This can include revenue from property taxes or the sale of public land or other assets.

Some states also rely on funds from their highway usage/revenue account, or HUR funds, which are generated from taxes on fuel, trucking permits, and registration fees for vehicles weighing over 10 tons.

Finally, some states issue capital-related debt through their county transportation revenue bond programs called MDOT County Transportation Revenue Bonds. This involves selling municipal securities to raise financing for road improvements and other Transportation Department projects at the county level.

State And Federal Sources💵💵

When it comes to financing their capital budgets, most states draw on a variety of different sources. At the state level, funds can be sourced from things like open space and waterway improvement programs, as well as economic development loans provided by the state government.

Additionally, many states also rely on federal grants and loans to help finance their capital projects. These can include funding from programs like the Community Development Block Grant (CDBG), highway funding, and transportation enhancement grants.

Overall, there are a wide variety of sources that states can draw from in order to fund their capital budgets, making it an important consideration for government planners in all states.

Utility Sources💵💵💵

As many state governments are aware, one of the most common methods that they use to finance their capital budget is through utilities. This typically includes issuing water and wastewater revenue bonds, which are paid back using future revenues from water and wastewater bills and fees.

Additionally, some states may use utility funds in order to finance their capital budget, tapping into the revenue that is generated directly from water and wastewater usage through things like bill payments or conduit fees.

Other Sources💵💵💵

Other sources include using county grants, which can come from state or federal sources. In addition, many states also rely on local impact aid, which typically consists of charitable donations from individuals or organizations in the local community.

How Do Most States Finance Their Capital Budget? Some states may also choose to raise private monies or draw upon critical area offset funds, though these funding sources tend to be less commonly used. In whatever way they are obtained, these funds are critical for supporting important infrastructure projects and ensuring the long-term economic growth of the state as a whole.

How Are State Budgets Created?

State budgets are one of the most important and complex documents that are created by state governments. These budgets detail the allocation of funds for a variety of different areas, including education, infrastructure, public safety, and health care.

Learn more about “How Do Most States Finance Their Capital Budget“? Getting a clear picture of how state budgets are developed and maintained can be challenging because of the hundreds of different factors that need to be taken into account. However, at the core, state budgets start with revenue projections.

These estimates take into accHow Do Most States Finance Their Capital Budgetount tax revenues from corporate, personal income taxes, sales taxes, and other sources. From there, spending proposals are crafted based on population growth estimates and inflationary pressures.

Finally, all of these various pieces come together in a process known as the budget reconciliation or passback process, which aims to ensure that all departments receive their fair share of funding while making sure that they do not overspend their allocated budgets.

While creating and maintaining state budgets can certainly be complex, understanding this process is essential for ensuring effective government services at both the state and local levels.

Conclusion: How Do Most States Finance Their Capital Budget

The article How Do Most States Finance Their Capital Budget provides an overview of how the states finance their capital budget. It is important for state legislators to understand the various options available to them in order to make sound financial decisions for their state.

Each option has its own set of pros and cons, which must be weighed against the needs of the state. State legislators will need to continue to explore new ways to finance their capital budget as the economy changes.